MGM Will Be Held to Host City Agreement in Possible Springfield Casino Sale, Say Officials

MGM Resorts International (NYSE: MGM) reportedly considered selling its regional casinos in Springfield, Massachusetts and Ohio over two months ago, according to rumors that appeared. If a deal happens, Massachusetts city officials stated they plan to hold the gambling corporation to the conditions of the host city agreement.

It was rumored in March that MGM would be considering selling MGM Northfield, a racino located close to Cleveland, as well as MGM Springfield.August 2018 saw the opening of MGM Springfield, Massachusetts's first traditional casino. Despite bringing in $278 million in sales in 2023, the venue has fallen short of the operator's projections.

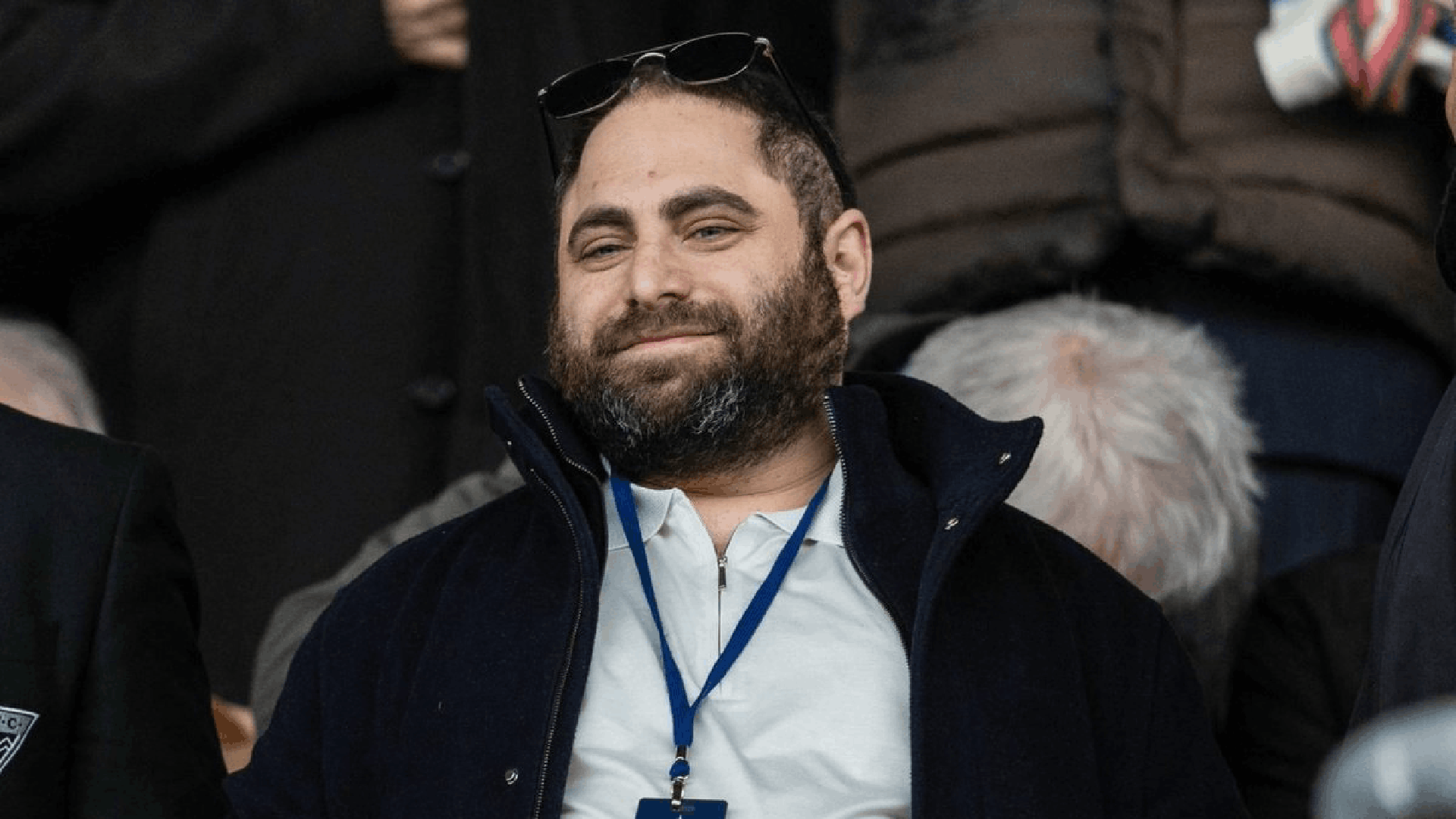

Michael Fenton, the president of the Springfield City Council and the chair of the committee overseeing the casinos, stated in a recent interview with Western Mass News that MGM cannot decide to leave the city on its own.

"I don’t think the public should be concerned because we have safeguards at the city and state level to make sure there’s no unilateral movement by MGM,” Fenton told the media outlet. “MGM doesn’t have the right to decide to move out on their own.”

The operator spent $960 million on the construction of the Massachusetts venue. In 2021, MGM paid $400 million to MGM Growth Properties (MGP) for the real estate holdings. In the same year, MGP was purchased by VICI Properties (NYSE: VICI) for $17.2 billion, giving them ownership of the property assets of several MGM venues, including MGM Northfield Park and the Springfield casino.

How Springfield Can Help MGM Do It Right

Although MGM has admitted that the casinos in Massachusetts and Ohio have fallen short of their goals, it hasn't stated out loud that it is exploring those locations. Earlier this month, during the operator's first-quarter results conference call, the subject was not discussed.

Finding a buyer within the gaming sector, if the operator is looking to sell, is the obvious way for MGM to allay Springfield's fears around a potential sale of the casino. This is significant as the property is zoned for gaming.

Although no names have been mentioned as possible purchasers of the operating rights of MGM Springfield, Penn Entertainment (NASDAQ: PENN), which operates Plainridge Park Casino in Massachusetts, is presumably a safe bet.

Tribal gaming organizations in New England might be considering MGM Springfield, but that is all conjecture at this point.

If the operator is trying to sell, the obvious method for MGM to ease Springfield's concerns about a possible sale of the casino would be to find a buyer within the gaming industry. Given that the land is zoned for gaming, this is significant.

While potential buyers of MGM Springfield's operating rights have not been identified, Penn Entertainment (NASDAQ: PENN), the company that runs Massachusetts' Plainridge Park Casino, is probably a good choice.

Though this is all speculation at this point, tribal gambling organizations in New England may be contemplating MGM Springfield.

Although experts think high loan rates are now impeding gaming sector mergers and acquisitions, a deal involving MGM Springfield could happen in the near future. This suggests that potential bidders who are unable to secure funding to purchase the venue's operating rights may postpone and forego placing a bid, so narrowing the pool of interested parties to those who are able to make a cash payment.